Santander’s Zinia becomes provider of consumer finance services for Apple in Germany

10 June 2024

Grupo Santander's financing platform becomes the financier for Apple in Germany, both in Apple stores and online at apple.de. Zinia has been present in Germany since 2022 and offers a range of financing solutions ('buy now, pay later' and instalments, among others).

Santander today announced that Zinia, its digital consumer finance platform, will become the new consumer finance provider for Apple in Germany.

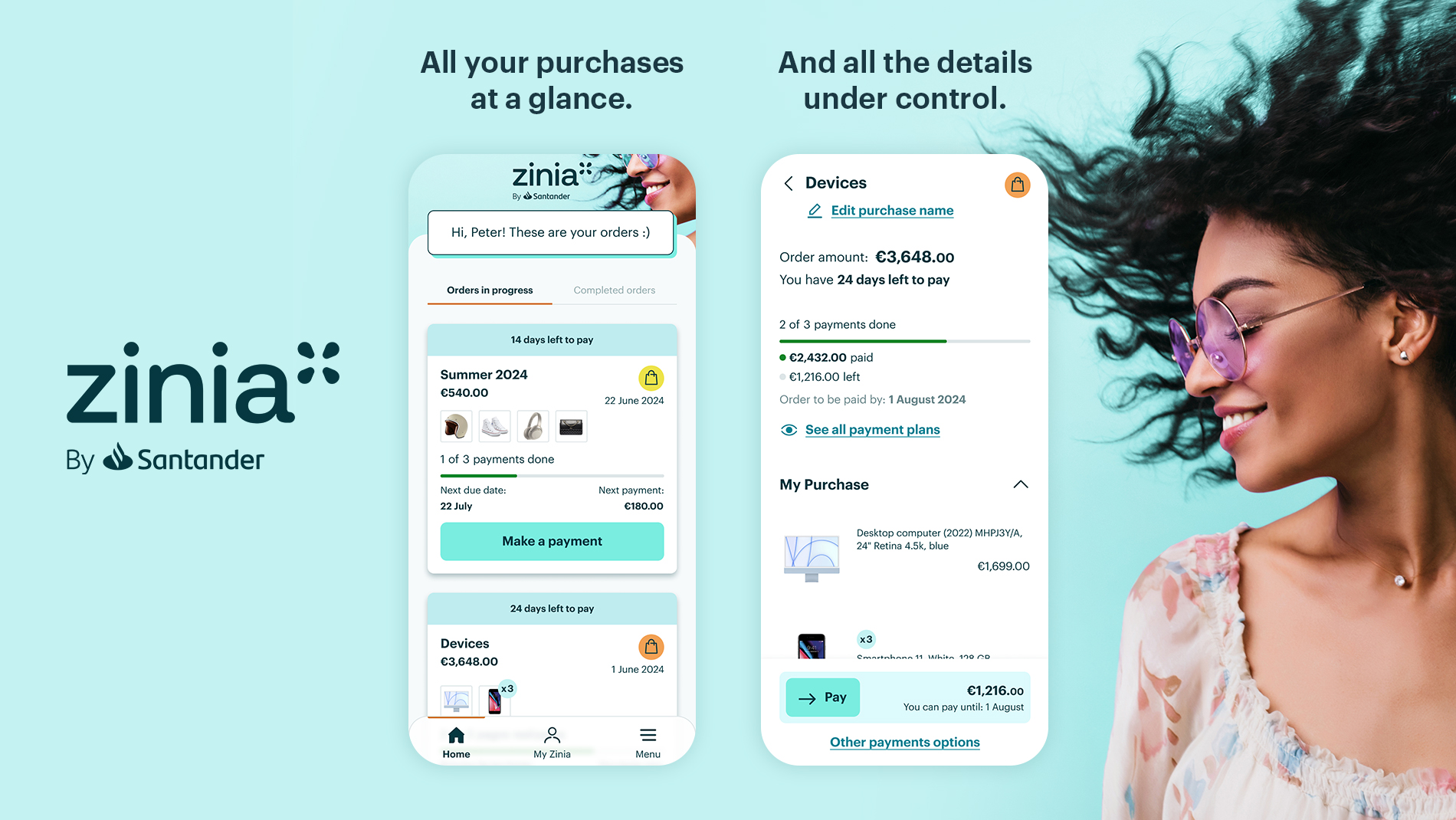

Zinia will offer customers purchasing Apple products both in Apple stores and online at apple.de the option to finance payments by splitting the total amount into instalments (3, 6, 12, 18, 24 and 36 months), or by settling the payment 30 days after the shipment (online) or pick-up in-store.

As part of the launch of this new agreement, in the coming months, Apple customers financing their purchases of an iPhone with Zinia will be able to do so in 12 or 24 interest-free instalments.

Zinia will offer Apple customers an agile, intuitive, and secure user experience to finance an iPhone, iPad, Apple Watch, Mac or any other devices at Apple stores or the Apple Store online in just a few seconds. To complete a transaction, customers only need to provide their phone number and date of birth, confirm the receipt of a security code and follow a quick validation process by logging in to their own online banking within the Apple Store online. All this, with the security and backing of a major financial group like Santander.

Since 2022, Zinia has been present in Germany offering a range of financing solutions ('buy now, pay later' and instalments, among others). In the coming months, it will continue to drive its expansion in Germany and other European countries.

Zinia is part of Santander’s Digital Consumer Bank, which holds the Group’s consumer finance business, providing financial services in 16 European countries through more than 130,000 associated points of sale.